unrealized capital gains tax meaning

Related to Unrealized Capital Gain. Unrealized Gain attributable to any item of Partnership property.

An Overview Of Capital Gains Taxes Tax Foundation

The net unrealized appreciation NUA is the difference in value between the average cost basis of shares and the current market value of.

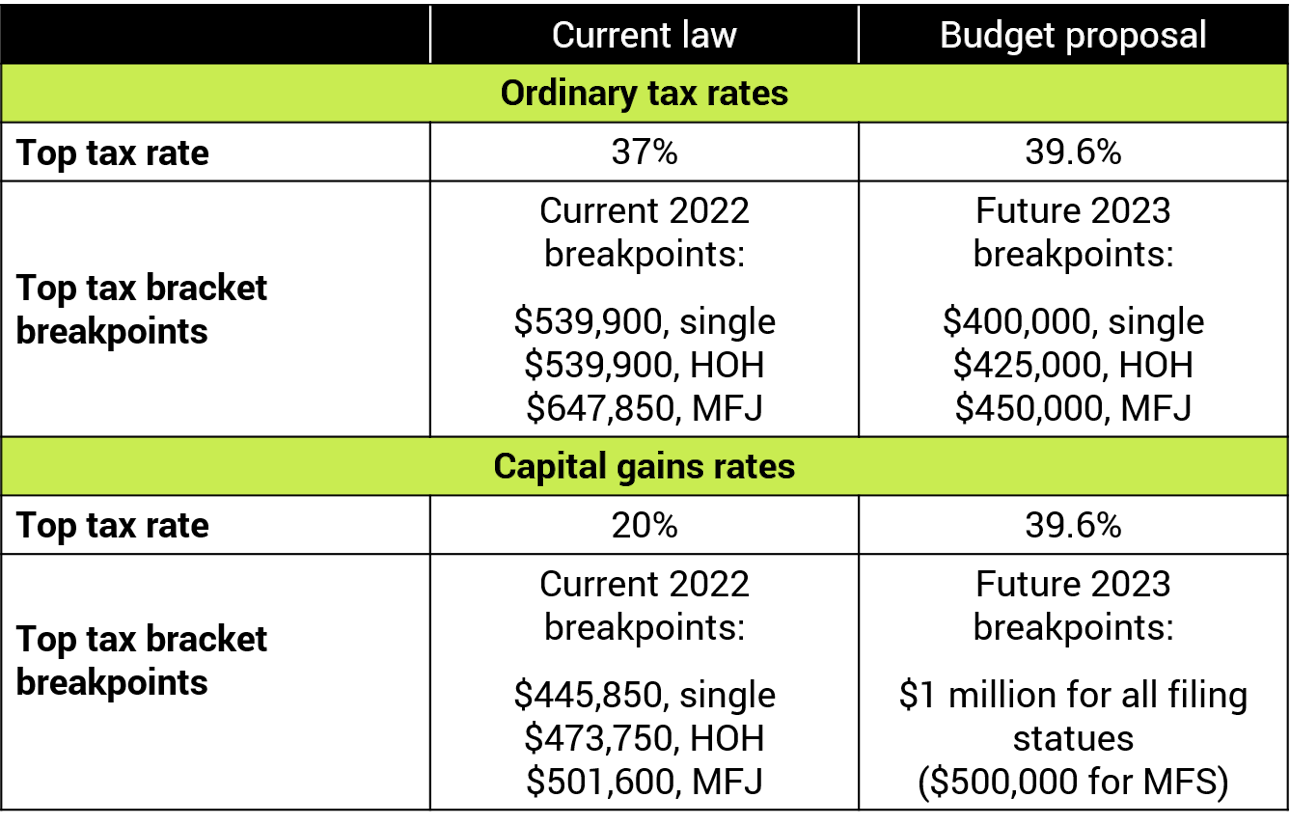

. Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth than the purchase price. The capital gains tax can be anywhere between zero and 37 depending on your income and how long you held the asset according to Wilson. If the proposal were passed.

Unrealized Gain Definition. Heres how to calculate it. Net Realized Capital Gains has the meaning ascribed thereto in subsection 42b hereof.

Unrealized capital gains are not taxed meaning a person who owns an asset that is worth more and more each year can defer paying income taxes on the appreciation. Taxes on short-term capital gains or assets. A capital gain is an increase in the value of an asset or investment resulting from the price appreciation of the asset or investment.

So even if the stock crashes or continues to rise it doesnt matter you sold your holdings and locked in a. The capital gains tax only applies to realized capital. The gain is not realized until the asset is.

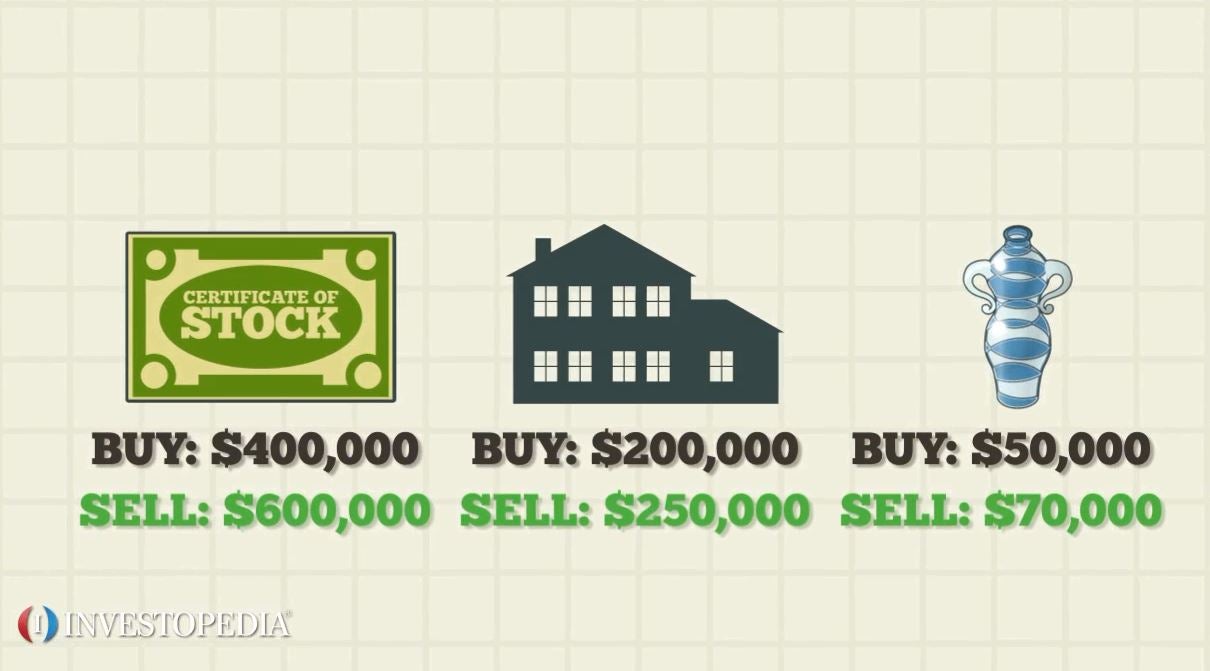

Net Unrealized Appreciation - NUA. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase. An unrealized gain is an increase in your investments value that you have not captured by selling the investment.

Do I have to pay. Capital Gains Tax. Capital gains meaning earnings from selling an asset for more than you bought it are taxable under federal tax law.

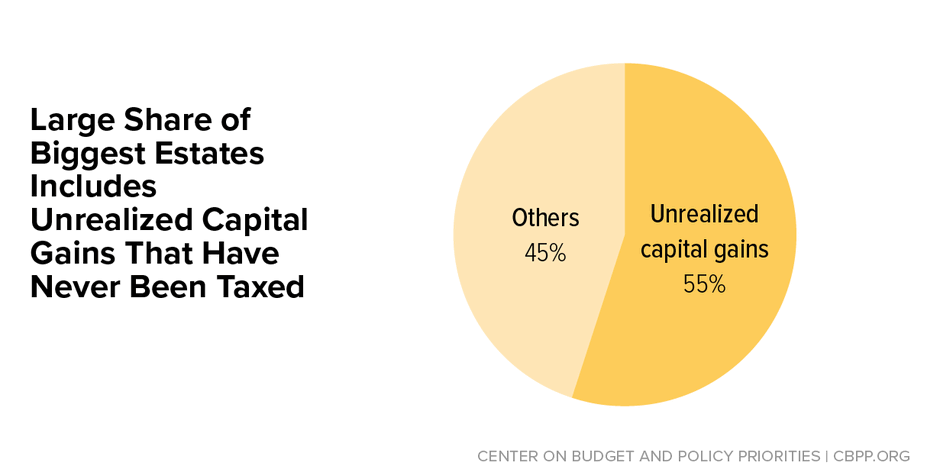

Unrealized gains are not taxed until you sell the investment. We estimate that taxing unrealized capital gains at death with a 1 million exemption and increasing the tax rate on capital gains and qualified dividends would raise. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. To increase their effective tax rate. A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares.

With respect to each Security held by the Partnership on the last day of an Interim Period the difference between i the value of the Security on such. The new proposal would tax unrealized capital gains meaning the wealthy would no longer be able to defer tax payments on gains made each year. The first example is realized because you sold the stock for 1100.

Define Unrealized Capital Gains or Losses. Unrealized Capital Gains means with respect to a security or other asset the amount by which the fair value of such security or other asset at the end of a fiscal year as determined by the. In other words the gain occurs when the.

Opinion Biden Proposes A Big Change To Capital Gains Taxes This Is How They Work And Are Calculated Marketwatch

Not Gaining Traction Biden Administration S Proposed Tax On Unrealized Capital Gains Comes To A Halt

How Much Musk Bezos Zuckerberg Would Pay Under Biden Billionaire Tax Plan

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gain Formula And Taxes Calculator Step By Step

Capital Gains Tax What It Is How It Works And Current Rates

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

What Are Capital Gains Definition Types Tax Implications Thestreet

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Biden Expresses Support For Annual Tax On Billionaires Unrealized Gains Wsj

What S The Deal With Capital Gains Taxes Foundation National Taxpayers Union

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

How Could Changing Capital Gains Taxes Raise More Revenue

Capital Gains Definition Rules Taxes And Asset Types

Realized Vs Unrealized Gains And Losses What S The Difference Marcus By Goldman Sachs

The Unintended Consequences Of Taxing Unrealized Capital Gains

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)